25+ Modules to Simplify Every Step of Vendor Management

Baseline & Vendor Management

Contract Compliance

Ensure adherence to contract compliance requirements and regulations.

Outreach & Events

Organize and manage outreach campaigns and events efficiently.

Utilization Plans

Build subcontractor plans and allocate subcontractors based on certification status and work categories.

Goal Calculation & Setting

Set and monitor contract- and project-specific participation goals based on US DOT standards.

Online Vendor Registration

Simplify the vendor registration process with online forms and workflow management.

Spend Analysis

Analyze and report on DBE/MBE/WBE/SBE utilization and expenditures to enhance program spend tracking.

Projects

Efficiently monitor and manage projects with multiple contracts through our vendor management software.

Certified Directory Connections

Access and manage certified directories seamlessly within the vendor management system.

Airport Concessions

Manage concession contracts efficiently with integrated tools in our easy-to-use vendor management software.

On The Job Training

Facilitate on-the-job training programs with streamlined processes.

Workforce

Accurately track and analyze workforce utilization data.

Certified Payroll / Prevailing Wage

Ensure compliance with prevailing wage rates and labor regulations.

Reviews

Track ongoing vendor review requirements and efficiently collect necessary information.

Hire Module

Manage the hiring process seamlessly with our vendor management software’s tools and workflows.

Sales Reporting

Submit detailed vendor sales reports online according to predefined policies.

Insurance Certification Management

Manage vendor insurance requirements directly in the vendor management software.

Dashboard & Economic Impact

Present program information and economic impact reports to the public.

Recipient Reporting Suite

Oversee enterprise small, local, and diverse business programs with comprehensive reporting tools.

Certification Suite

Streamline certification management with automated processes and audit trails.

Bid Management Suite

Facilitate bid posting, bid tracking, and online bidding through our integrated vendor management software tools.

Baseline & Vendor Management

Make compliance easy. Make a difference in the community.

Discover how our vendor management, prevailing wage labor compliance, and grant management software solutions help you streamline processes and allow you to deliver greater impact to your community.

Related Labor Compliance Software

Enhance Efficiency and Comply with Labor Laws

Easily collect, track, monitor, and manage certified payrolls in

compliance with Davis-Bacon and Related Acts, Service Contract Act, State Prevailing Wage Laws, and Local Living Wage Ordinances.

Prevailing Wage Compliance Software

Davis-Bacon Labor Compliance Software

Prevailing Wage Software FAQs

Prevailing Wage Software, like B2Gnow’s eComply Prevailing Wage Software, helps agencies and contractors comply with prevailing wage laws. The prevailing wage is the combination of the basic hourly pay rate plus any fringe benefits assigned to a specific classification of workers. It is based on similarly employed workers in a given region, as well as historical data. This ensures that workers hired for certain federally funded construction projects, as outlined in the Davis-Bacon Act, are paid a fair, locally adjusted wage. Prevailing wage software helps contractors and public sector agencies keep track of worker wages and hours for a specific project and compares that with the prevailing wage in the system to identify any discrepancies.

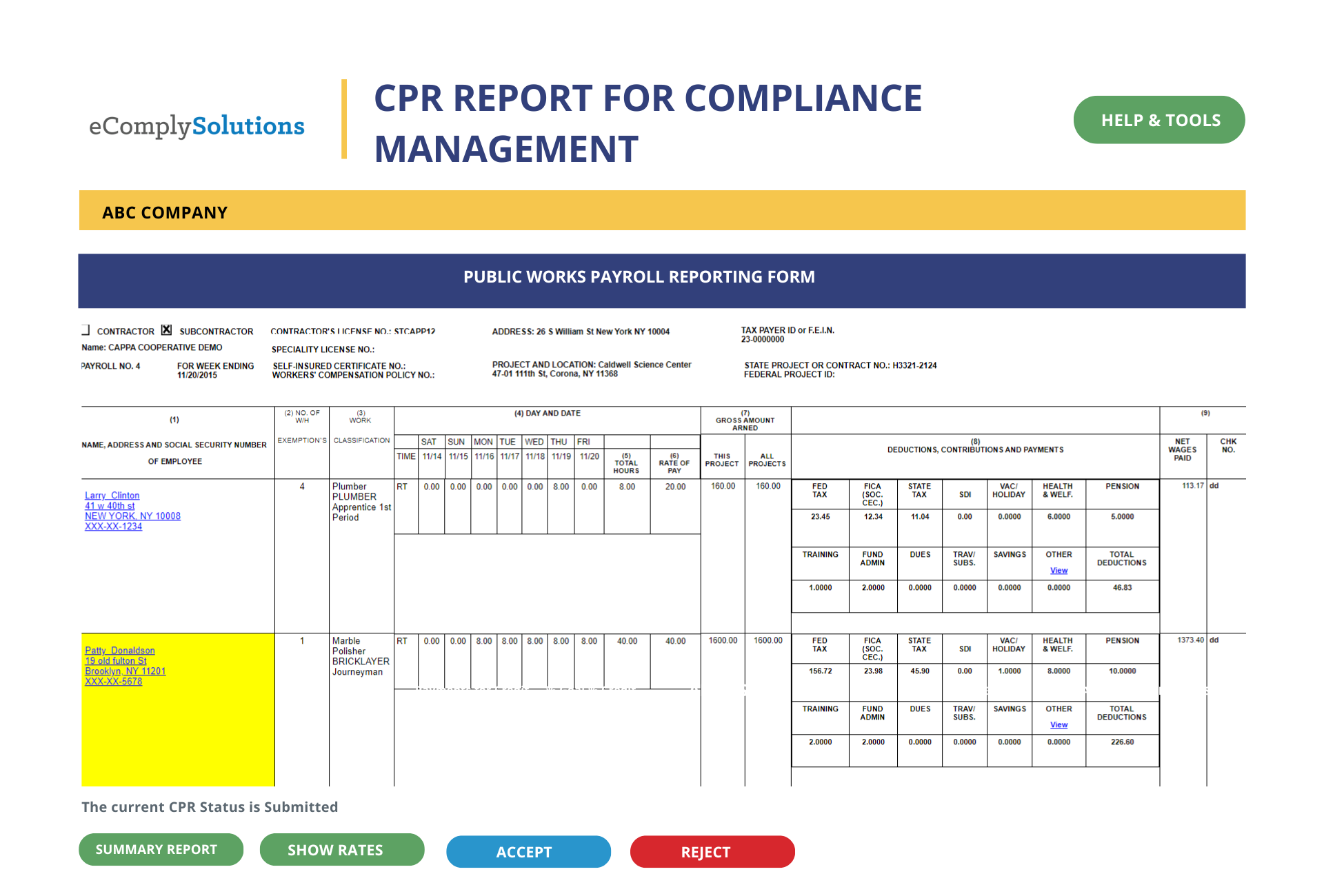

- Certified Payroll Reporting Made Easy: Generate accurate WH-347 forms and other required reports with ease. Our software integrates with major payroll systems, reducing manual data entry and minimizing errors.

- Automated Davis-Bacon & SCA Compliance: Stay up-to-date with automatic wage determination updates and classification support, ensuring compliance with federal and state regulations.

- Real-Time Audit-Readiness: Maintain digital audit trails and compliance dashboards that provide instant visibility into your labor compliance status, helping you address issues proactively.

- Workforce and Subcontractor Oversight: Manage onboarding, labor classifications, and wage tracking for both general contractors and subcontractors, ensuring comprehensive compliance across all project participants.

- Contractors & Construction Firms: Simplify compliance processes and reduce administrative burdens.

- Government Agencies: Ensure transparency and accountability in public works projects.

- Compliance Consultants: Provide clients with reliable tools to maintain compliance.

- Labor Compliance Managers: Monitor and enforce labor standards effectively.

The Davis-Bacon Act applies to construction projects and mandates prevailing wage rates for laborers and mechanics, while the Service Contract Act covers service contracts and sets wage standards for service employees.

Prevailing wage Payroll software helps contractors and agencies keep track of worker wages and hours for a specific project and compares that with the prevailing wage in the system to identify any discrepancies.

It enables them to run Certified Payroll Reports (CPRs), which will flag if a discrepancy is found. This allows the contractor to correct it and ensures the worker is paid correctly before submitting it to the overseeing agency, which reduces the chance of being audited and penalized.

B2Gnow’s eComply Prevailing Wage Software can easily track and monitor prevailing wage standards in a modern, cloud-based platform and replace manual, time-consuming processes for complying with federal Davis-Bacon requirements (and their state and local law counterparts) with efficient, automated processes.

When sourcing Prevailing Wage Certified Payroll software, several features are essential:

Secure, Cloud-based system – The ability to digitize documents and eliminate manual processes for Davis-Bacon requirements and any state and local prevailing wage laws and project labor agreements.

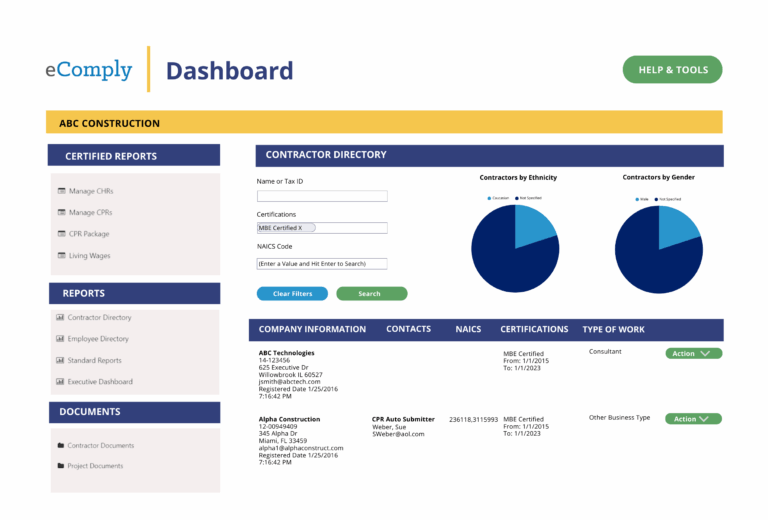

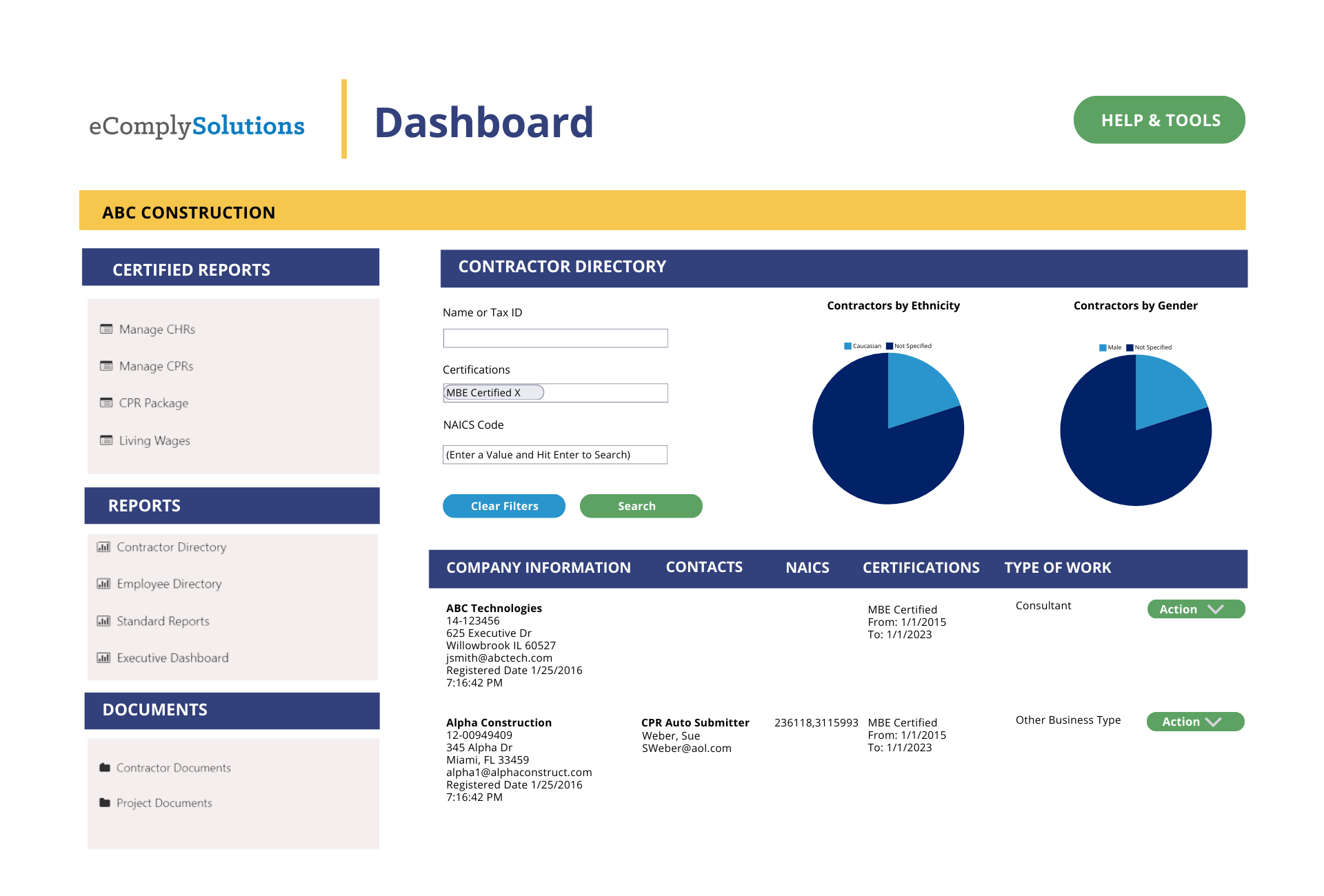

Dashboards – Access to a quick at-a-glance view of the number of CPRs submitted, geographic impact analysis, announcements, etc. The dashboard should be able to be configured to meet specific needs.

Rate management – The software should include a rates team that manages the entry and update of all rates at no additional service fee.

Automated cross-checking – Upon CPR submission, the system should automatically check the rates reported on the CPR against pre-loaded rates. Any discrepancy is highlighted when the client logs in to review the CPR.

Templated Emails – Clients can reject the CPR and send a templated email response to the contractor regarding the violation and the corrective action. The contractor should receive the rejection notification and can then correct the violation and resubmit the CPR.

One centralized system – A top prevailing wage payroll software will track all vital information and communications in the system. This maintains the chain of custody for audit purposes, as all versions of a particular certified payroll will be stored within the system.

Comprehensive Compliance Management – Option to leverage an integration solutions that manages prevailing wage labor compliance requirements alongside diversity and inclusion goals, providing agencies and contractors with a more efficient and comprehensive compliance management solution for public infrastructure projects.

Industries that work on government-funded or public projects and must comply with prevailing wage laws and detailed reporting requirements, such as public sector entities (state DOTs, states, cities, counties, airports, transits, education, housing authorities, and other municipal agencies), as well as construction and engineering firms, benefit from using prevailing wage payroll software.

The agency benefits because the software provides visibility into prevailing wage and actual pay, allowing them to identify errors. The contractor benefits because they can verify their workers are being paid accurately while reducing paperwork and data entry. The workers benefit because the software will ensure they are paid what they are owed.

With advanced data security, data integrations, and unparalleled training and customer support, eComply empowers agencies and contractors to maintain audit readiness, enhance operational efficiency, and protect their reputations. At the same time, ensuring workers receive fair wages as mandated by law.

The B2Gnow eComply Prevailing Wage module integrates with legacy systems and payroll systems for data exchange and seamless integration.

Benefits of using prevailing wage compliance software include but are not limited to:

Time savings – by automating and digitizing the certified payroll and prevailing wage processes, staff save time performing manual research and data entry. Additionally, reports that used to take weeks to put together can now be created—with data pulled directly from CPRs—in a matter of seconds.

Cost savings – Staff can perform prevailing wage tasks in a shorter time period, which leaves them open to moving on to higher-value tasks. Also, by eliminating paper documents, organizations will save money by eliminating paper, filing cabinets, storage fees, and more.

Accuracy – automated calculations and vendor and employee data matching from the contract compliance module remove the chance of spelling errors, math errors, and data duplication.

Easy implementation – by integrating with an organization’s legacy systems, the prevailing wage software implementation can be smooth and fit right into existing processes.

Flexibility – Prevailing wage software should be built to accommodate, delivering optimum results without delay or additional cost. It should be a scalable solution that easily absorbs new business rules and workflows.

Audit Ready – With prevailing wage software, organizations won’t have to worry about audits again. Customers should always remain compliant and audit-ready with instant access to full historical documentation.

Best in Class Prevailing Wage Software – Organizations who leverage B2Gnow’s eComply benefit from a seasoned team with over two decades of experience. No other solution is as comprehensive or as widely implemented. Our team includes former program managers with direct experience in supplier diversity, labor compliance, and grant management. More than 400 clients use B2Gnow every day.

Yes, Prevailing Wage software should be customizable for each client. Configurable items should include dashboards, email templates, agency requirements and step-by-step directions, updates to the local prevailing wage, legacy software integration, and more.

Prevailing wage software vendors should provide full staff training and U.S.-based customer support.

The software vendor should train staff, contractors, and subcontractors to be ready to use the software once implemented. Training videos, recorded webinars, FAQs, and user guides should also be readily available for users when needed. Organizations that leverage B2Gnow’s eComply Prevailing Wage Software benefit from a seasoned team with over two decades of experience. No other solution is as comprehensive or as widely implemented.

Our team includes former program managers with direct experience in supplier diversity, labor compliance, and grant management. More than 400 clients use B2Gnow every day.

Prevailing wage software should include regular updates of locally listed prevailing wages. B2Gnow’s eComply wage rate team monitors prevailing wages for each customer’s contracted project and updates the system to ensure it is compliant, free of charge. This removes one more task the customer needs to manage.

Organizations should consider several factors when selecting a prevailing wage compliance software solution.

Experience and expertise of the software vendor – a company built on the needs of the industry it supports with employees who worked in that industry previously.

Transparency of the software vendor – The software vendor should be straightforward with pricing and associated fees.

Custom support – the customer support team should be experienced with prevailing wage laws and the software itself. The support team should be able to close the majority of tickets with the first customer call.

Modern SaaS technology – cloud-based SaaS business model reduces costs, can scale when needed, and reduces burdens of the customer’s IT team. New features and updates are pushed out live with no assistance needed by the IT team.

Security – the software vendor should guarantee that the customer’s data is secure. Security features to look for include SOC2 Type II compliant, independent auditing for security and privacy protocols in handling confidential information for clients, SHA-2 2048-bit SSL certificate on the HTTPS level, 256-bit AES SQL Server-based encryption at the database level, and extensive cyber liability coverage. Additionally, customers should be able to assign permissions by employee roles and control who can view, edit, and manage project details.

Best-in-Class – With over two decades of experience in prevailing wage software, B2Gnow’s eComply team brings a wealth of knowledge to help you achieve your compliance goals. Compliance isn’t just about following regulations—it’s about doing what’s right. The U.S. Department of Labor (DOL) oversees and enforces more than 180 federal laws, including the Davis-Bacon and Related Acts (DBRA), to address wage and employment disparities. With over 150 million workers across 10 million workplaces, also affected by various state and local prevailing wage laws, it’s essential to implement an automated Prevailing Wage Software solution, like eComply, to ensure prevailing wage compliance, track apprenticeship to journeyman ratios, monitor workforce utilization, and meet hiring goals.

Industries that benefit from prevailing wage compliance software include those that work on government-funded or public projects and must comply with prevailing wage laws and detailed reporting requirements such as public sector entities (state DOTs, states, cities, counties, airports, transits, education, housing authorities, other municipal), as well as construction and engineering firms.

Absolutely. It streamlines compliance processes, reduces administrative workload, and minimizes the risk of costly penalties due to non-compliance.